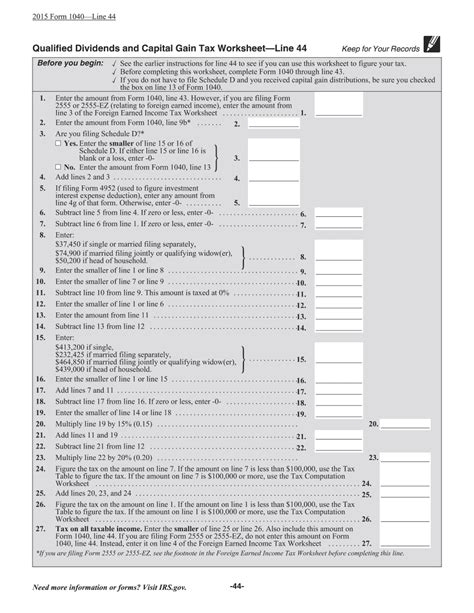

Qualified dividends and capital gains are taxed at a lower rate than ordinary income, making them an attractive investment option for many individuals. The Qualified Dividends and Capital Tax Worksheet is a tool used by taxpayers to calculate the amount of tax owed on these types of investment income.

When you receive qualified dividends or realize capital gains, you may be subject to capital gains tax. The tax rate on qualified dividends and capital gains depends on your income level and filing status. Using the Qualified Dividends and Capital Tax Worksheet can help you determine the appropriate tax rate for your investment income.

Qualified Dividends And Capital Gain Tax Worksheet 2017 Worksheet (www.thesecularparent.com)

Qualified Dividends And Capital Gain Tax Worksheet 2017 Worksheet (www.thesecularparent.com)

The worksheet takes into account your filing status, taxable income, and the type and amount of investment income you have received. By following the instructions on the worksheet, you can calculate the tax owed on your qualified dividends and capital gains and ensure that you are paying the correct amount of tax to the IRS.

It is important to accurately complete the Qualified Dividends and Capital Tax Worksheet to avoid underpayment or overpayment of taxes on your investment income. Failing to properly calculate the tax owed on qualified dividends and capital gains can result in penalties and interest charges from the IRS.

Consulting with a tax professional or using tax preparation software can help ensure that you accurately complete the Qualified Dividends and Capital Tax Worksheet and file your taxes correctly. By understanding how to calculate the tax owed on your investment income, you can make informed decisions about your investments and minimize your tax liability.

In conclusion, the Qualified Dividends and Capital Tax Worksheet is a valuable tool for individuals with investment income to calculate and pay the appropriate amount of tax on their qualified dividends and capital gains. By accurately completing the worksheet and understanding the tax implications of your investment income, you can effectively manage your tax obligations and optimize your investment strategy.