When it comes to taxes, understanding the different types of income and how they are taxed is essential. Qualified dividends and capital gains are two types of income that are taxed at a different rate than ordinary income. It is important to know how to calculate the tax on these types of income to ensure you are paying the correct amount to the IRS.

Qualified dividends are dividends paid by a U.S. corporation or a qualified foreign corporation that meet certain requirements set by the IRS. These dividends are taxed at the capital gains tax rate, which is generally lower than the ordinary income tax rate. This can result in significant tax savings for investors who receive qualified dividends.

Qualified Dividends And Capital Gain Tax Worksheet For 2023 A (worksheets.clipart-library.com)

Qualified Dividends And Capital Gain Tax Worksheet For 2023 A (worksheets.clipart-library.com)

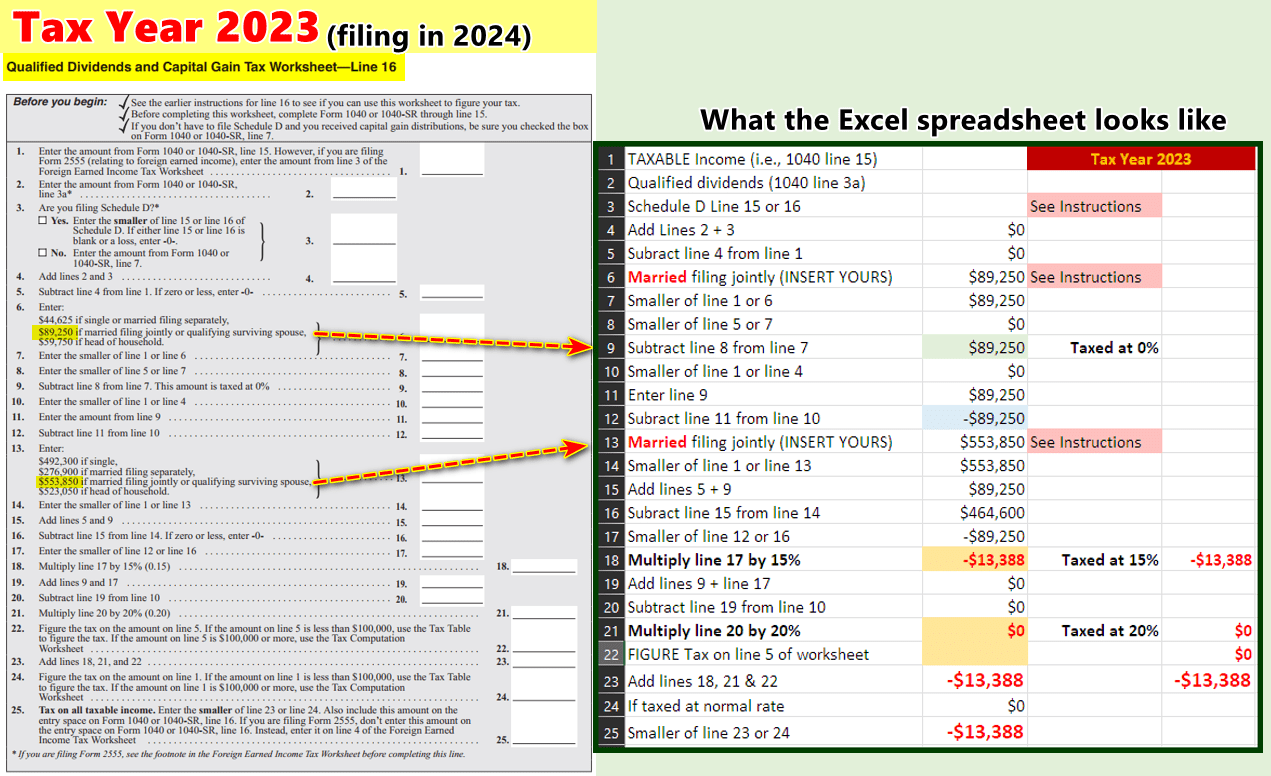

Qualified Dividends And Capital Gain Tax Worksheet

The Qualified Dividends and Capital Gain Tax Worksheet is a form provided by the IRS to help taxpayers calculate the tax on their qualified dividends and capital gains. This worksheet takes into account various factors, such as filing status, taxable income, and the amount of qualified dividends and capital gains received.

To use the worksheet, taxpayers must first determine their taxable income and adjust it for any deductions or credits they are eligible for. They then calculate the tax on their ordinary income using the tax brackets for their filing status. Next, they calculate the tax on their qualified dividends and capital gains using the capital gains tax rate.

Once the tax on both types of income has been calculated, taxpayers can then determine their total tax liability for the year. This can help them plan for any additional taxes that may be owed or adjust their withholding to avoid underpayment penalties.

It is important to note that not all dividends qualify for the lower tax rate. Dividends that do not meet the IRS requirements for qualified dividends are taxed at the ordinary income tax rate. Taxpayers should carefully review their dividend income to ensure they are correctly reporting and paying taxes on it.

In conclusion, the Qualified Dividends and Capital Gain Tax Worksheet is a valuable tool for taxpayers who receive qualified dividends and capital gains. By using this worksheet, taxpayers can ensure they are paying the correct amount of tax on these types of income and take advantage of the lower capital gains tax rate. It is important to carefully review the requirements for qualified dividends and consult with a tax professional if needed to ensure compliance with IRS regulations.