Managing finances is an essential part of running a successful business. One tool that can help business owners keep track of their income and expenses is a Profit and Loss Worksheet. This simple worksheet allows you to see how much money your business is making or losing over a specific period of time.

By using a Profit and Loss Worksheet, you can easily monitor your business’s financial health and make informed decisions to improve profitability. This tool can help you identify areas where you can cut costs, increase revenue, or make other adjustments to boost your bottom line.

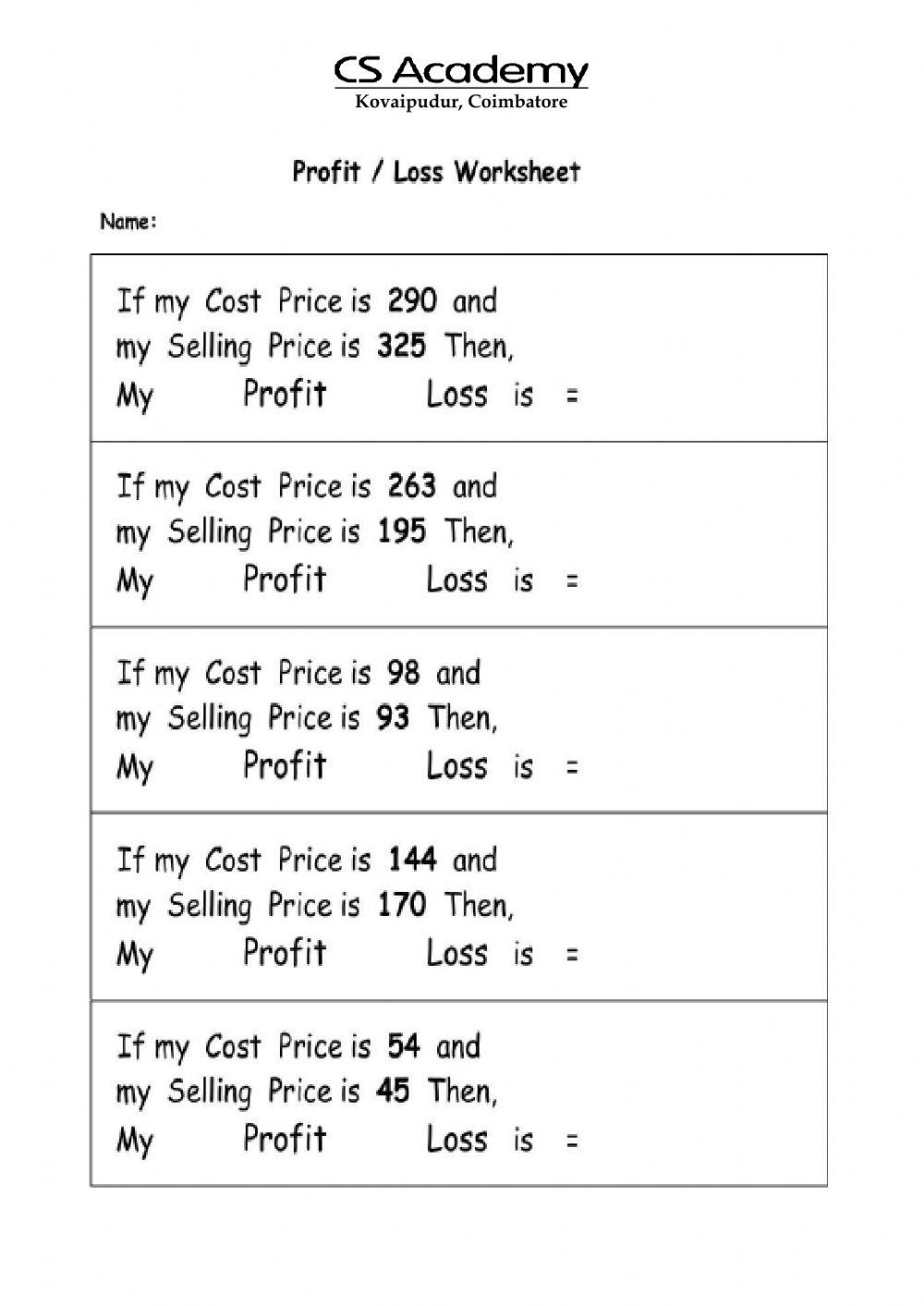

Simple Profit Loss Spreadsheet Pertaining To Luxury Simple Profit And (db-excel.com)

Simple Profit Loss Spreadsheet Pertaining To Luxury Simple Profit And (db-excel.com)

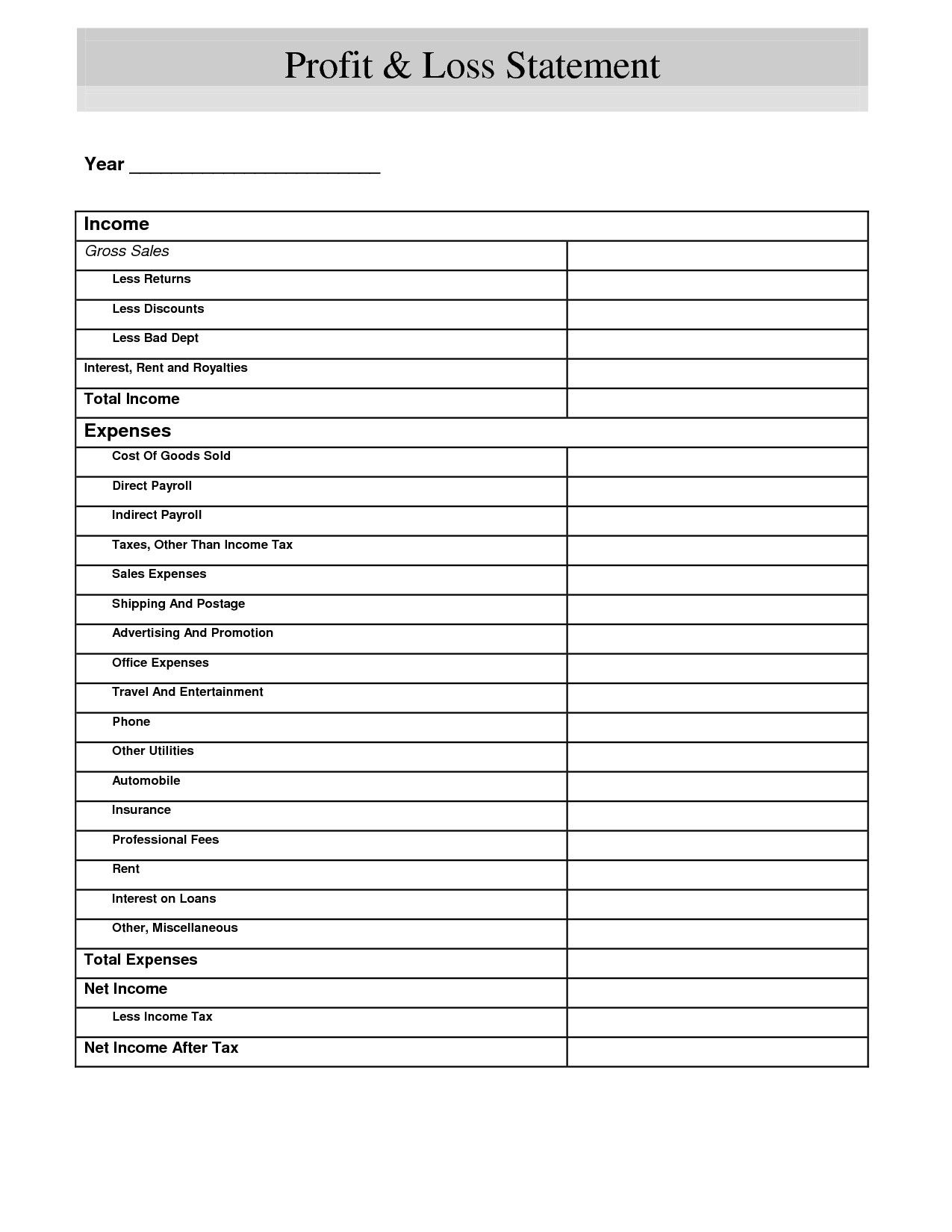

When creating a Simple Profit and Loss Worksheet, start by listing all your sources of income, such as sales, services, or other revenue streams. Next, list all your expenses, including rent, utilities, payroll, supplies, and any other costs associated with running your business. Finally, subtract your total expenses from your total income to calculate your net profit or loss.

Regularly updating and reviewing your Profit and Loss Worksheet can help you stay on top of your finances and make timely decisions to improve your business’s financial performance. By tracking your income and expenses, you can identify trends, set financial goals, and make adjustments as needed to ensure the long-term success of your business.

Overall, a Simple Profit and Loss Worksheet is a valuable tool for any business owner looking to manage their finances more effectively. By using this tool to track your income and expenses, you can gain a better understanding of your business’s financial health and make informed decisions to drive growth and profitability.