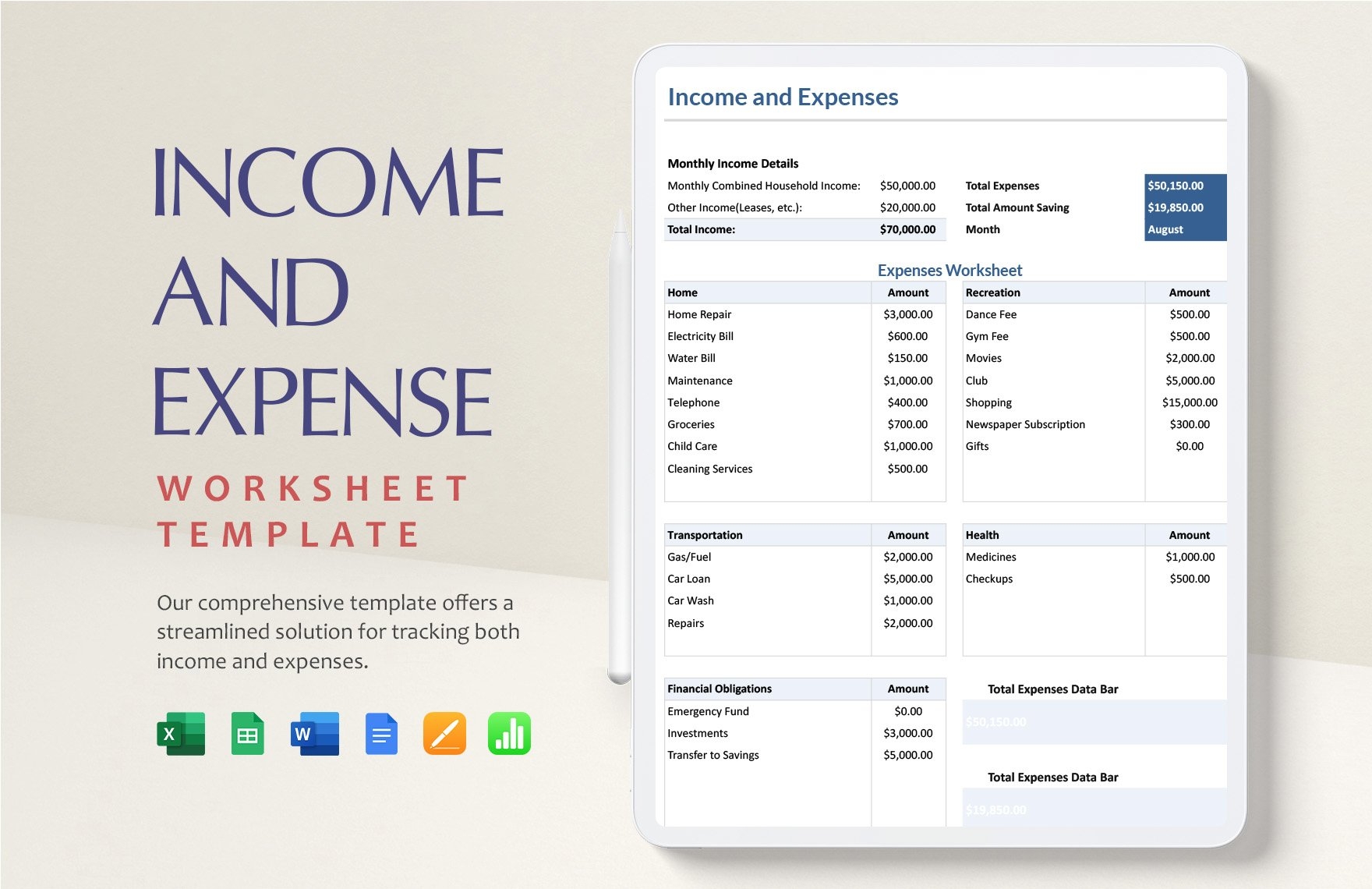

Managing your finances is crucial for achieving financial stability and reaching your financial goals. One way to keep track of your income and expenses is by using an Income and Expense Worksheet. This tool can help you understand where your money is coming from and where it is going, allowing you to make informed decisions about your finances.

Creating an Income and Expense Worksheet is a simple and effective way to organize your financial information. By listing all sources of income and expenses, you can get a clear picture of your financial situation and identify areas where you can cut costs or increase income.

Rental Income And Expense Worksheet Fact Professional Worksheets (worksheets.clipart-library.com)

Rental Income And Expense Worksheet Fact Professional Worksheets (worksheets.clipart-library.com)

When creating an Income and Expense Worksheet, start by listing all sources of income, such as salary, bonuses, rental income, or any other sources of money coming in. Next, list all your expenses, including rent/mortgage, utilities, groceries, transportation, entertainment, and any other regular expenses. Be sure to include both fixed expenses (such as rent) and variable expenses (such as groceries).

Once you have listed all your income and expenses, calculate your total income and total expenses. This will give you a clear picture of your financial health and whether you are living within your means. If your expenses exceed your income, you may need to find ways to cut costs or increase your income to achieve financial stability.

Regularly updating your Income and Expense Worksheet is essential for staying on top of your finances. By tracking your income and expenses on a monthly basis, you can identify any changes in your financial situation and make adjustments accordingly. This can help you avoid overspending, save money, and work towards achieving your financial goals.

In conclusion, an Income and Expense Worksheet is a valuable tool for managing your finances and achieving financial stability. By tracking your income and expenses, you can make informed decisions about your finances and work towards reaching your financial goals. Take the time to create and update your Income and Expense Worksheet regularly to stay on top of your finances and secure your financial future.