When it comes to taxes, deductions play a crucial role in reducing the taxable income and ultimately lowering the tax liability. A deductions worksheet is a tool that helps individuals or businesses track and calculate their deductible expenses. By keeping track of these expenses, taxpayers can maximize their deductions and potentially save money on their taxes.

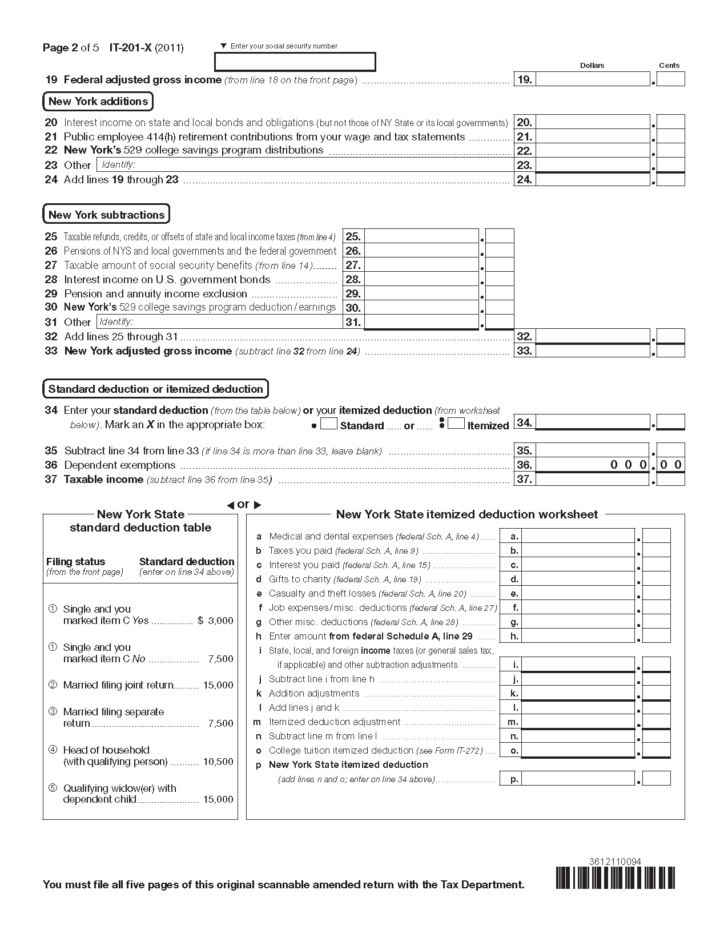

It is important to note that not all expenses are deductible, and the IRS has specific guidelines for what can be considered a deductible expense. Common deductions include mortgage interest, medical expenses, charitable contributions, and business expenses. The deductions worksheet helps taxpayers organize and categorize these expenses to ensure they are properly accounted for on their tax return.

Income Tax Deductions Income Tax Deductions Worksheet Db Excel (db-excel.com)

Income Tax Deductions Income Tax Deductions Worksheet Db Excel (db-excel.com)

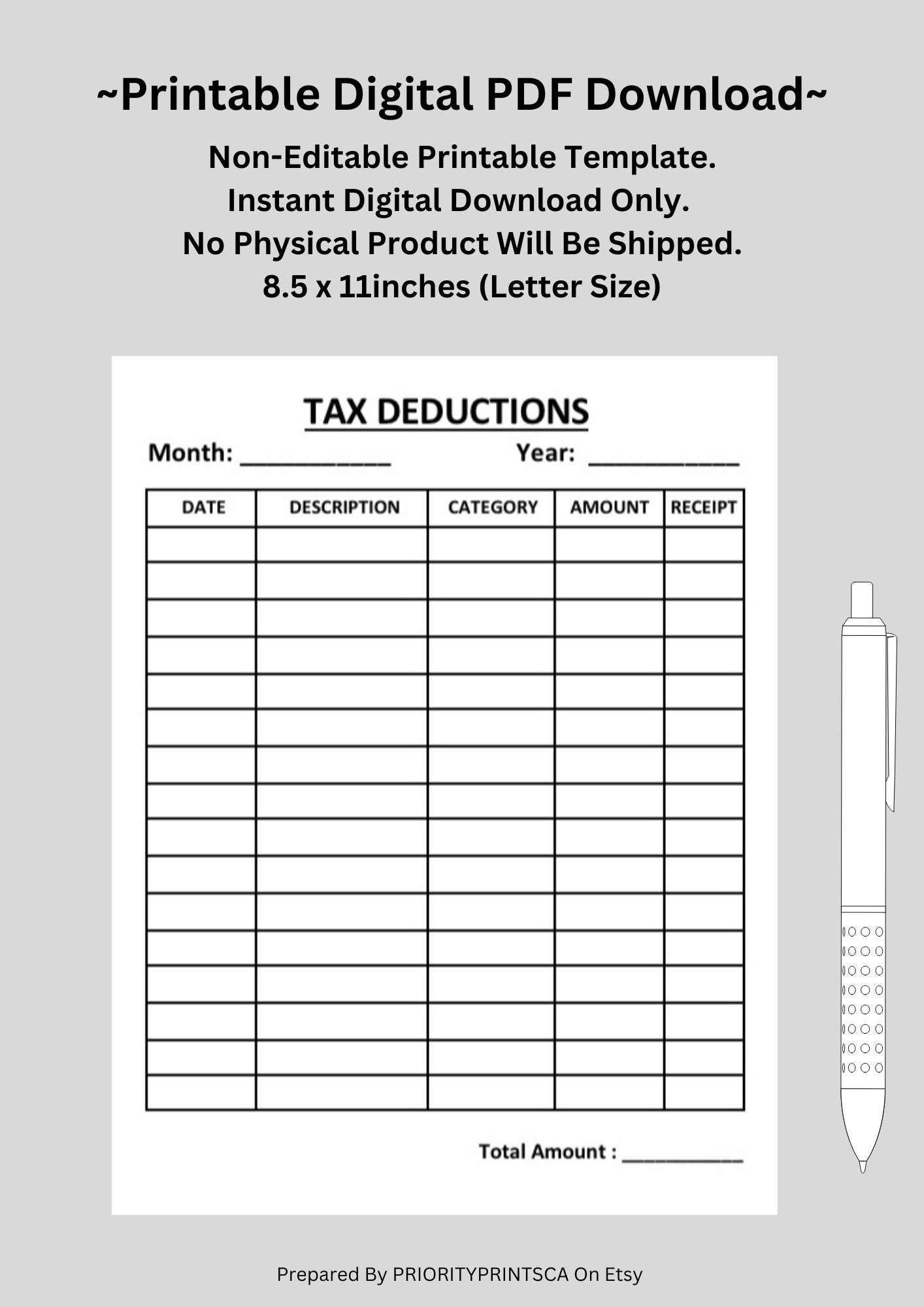

Deductions Worksheet

The deductions worksheet typically includes categories for different types of expenses, such as home-related expenses, medical expenses, education expenses, and miscellaneous expenses. Taxpayers can list each expense under the appropriate category and keep track of the total amount spent throughout the year. This information is then used to determine the total deductible amount for each category.

One of the key benefits of using a deductions worksheet is that it helps taxpayers stay organized and ensures they don’t overlook any potential deductions. By keeping detailed records of expenses and receipts, taxpayers can easily reference the information when it comes time to file their taxes. Additionally, the deductions worksheet can serve as a helpful tool for tax planning, allowing individuals to estimate their potential deductions and make informed decisions throughout the year.

It is important to update the deductions worksheet regularly to reflect any changes in expenses or tax laws. By staying proactive and keeping accurate records, taxpayers can avoid any last-minute scrambling and ensure they are taking full advantage of all available deductions. Whether using a physical worksheet or an online tool, the key is to maintain thorough and detailed records of deductible expenses.

In conclusion, a deductions worksheet is a valuable tool for individuals and businesses looking to maximize their tax deductions. By keeping track of deductible expenses throughout the year, taxpayers can reduce their taxable income and potentially lower their tax liability. Whether using a simple spreadsheet or a more sophisticated software program, the key is to stay organized and diligent in tracking expenses. By utilizing a deductions worksheet, taxpayers can ensure they are taking full advantage of all available deductions and saving money on their taxes.