Managing finances is crucial for any business, and having a clear understanding of your profit and loss is essential for making informed decisions. Excel sheets are a powerful tool that can help you track your income and expenses, allowing you to analyze your financial performance effectively.

By using Excel sheets to create profit and loss statements, you can easily organize your financial data and generate comprehensive reports. This enables you to identify areas where you are making a profit and where you may need to cut costs or increase revenue.

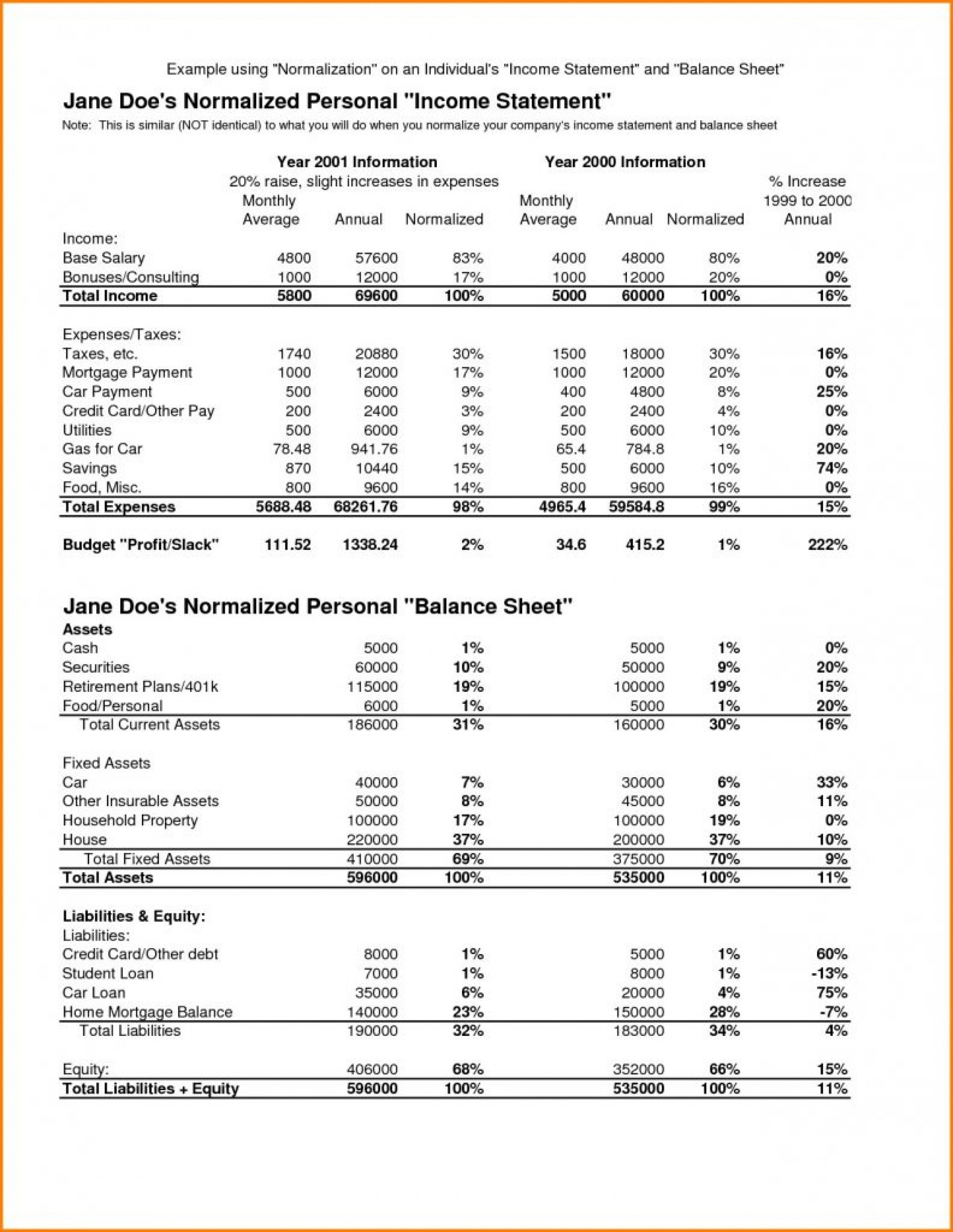

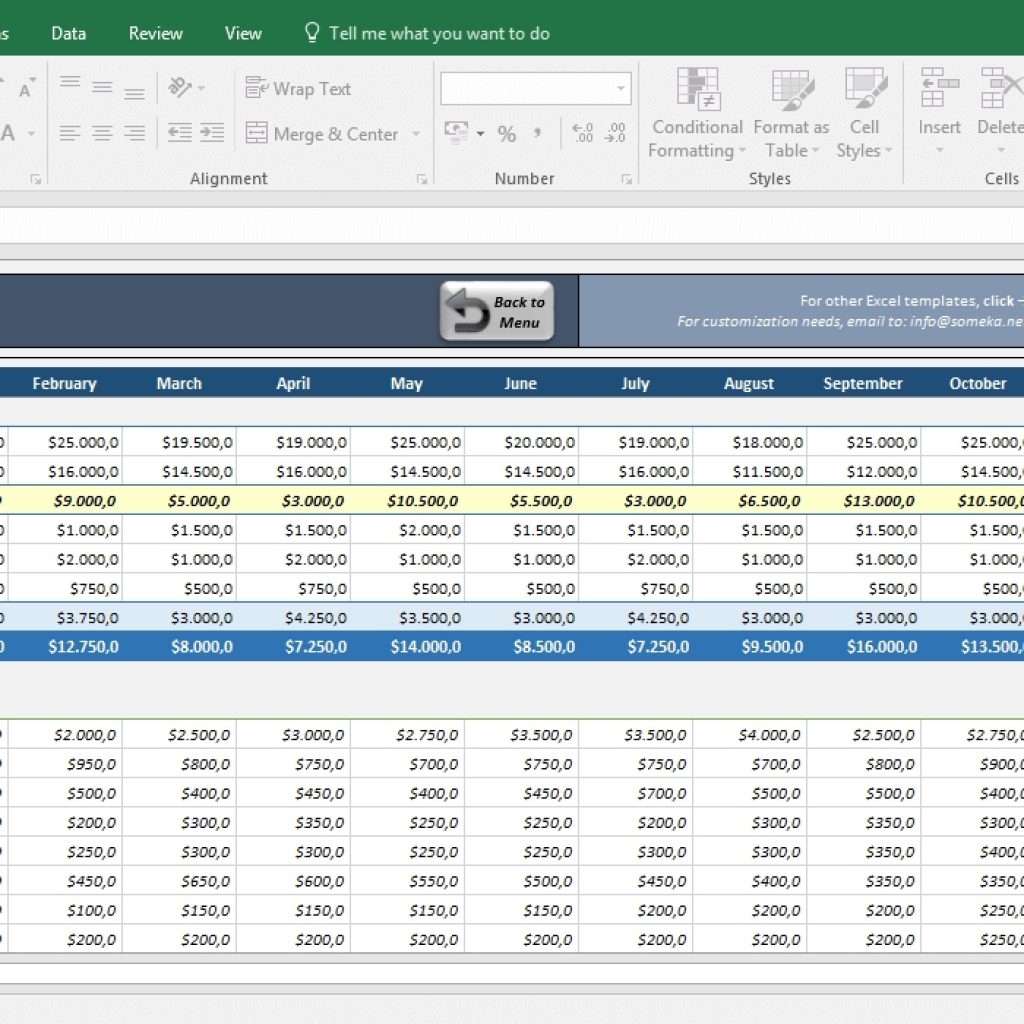

Profit And Loss Excel Spreadsheet Db Excel (db-excel.com)

Profit And Loss Excel Spreadsheet Db Excel (db-excel.com)

One of the key benefits of using Excel for profit and loss statements is the ability to customize your reports to suit your specific needs. You can create formulas to automatically calculate key financial metrics such as net profit, gross profit margin, and operating expenses, giving you a clear picture of your financial health.

Additionally, Excel allows you to create charts and graphs to visualize your financial data, making it easier to spot trends and patterns in your revenue and expenses. This can help you identify opportunities for growth and potential areas for improvement in your business operations.

Overall, Excel sheets are a valuable tool for tracking and analyzing your profit and loss, providing you with the insights you need to make informed financial decisions. By leveraging the power of Excel, you can gain a better understanding of your business’s financial performance and take steps to improve your bottom line.

In conclusion, Excel sheets are an essential tool for managing your profit and loss effectively. By utilizing Excel’s features to organize and analyze your financial data, you can gain valuable insights into your business’s financial health and make informed decisions to drive growth and success.