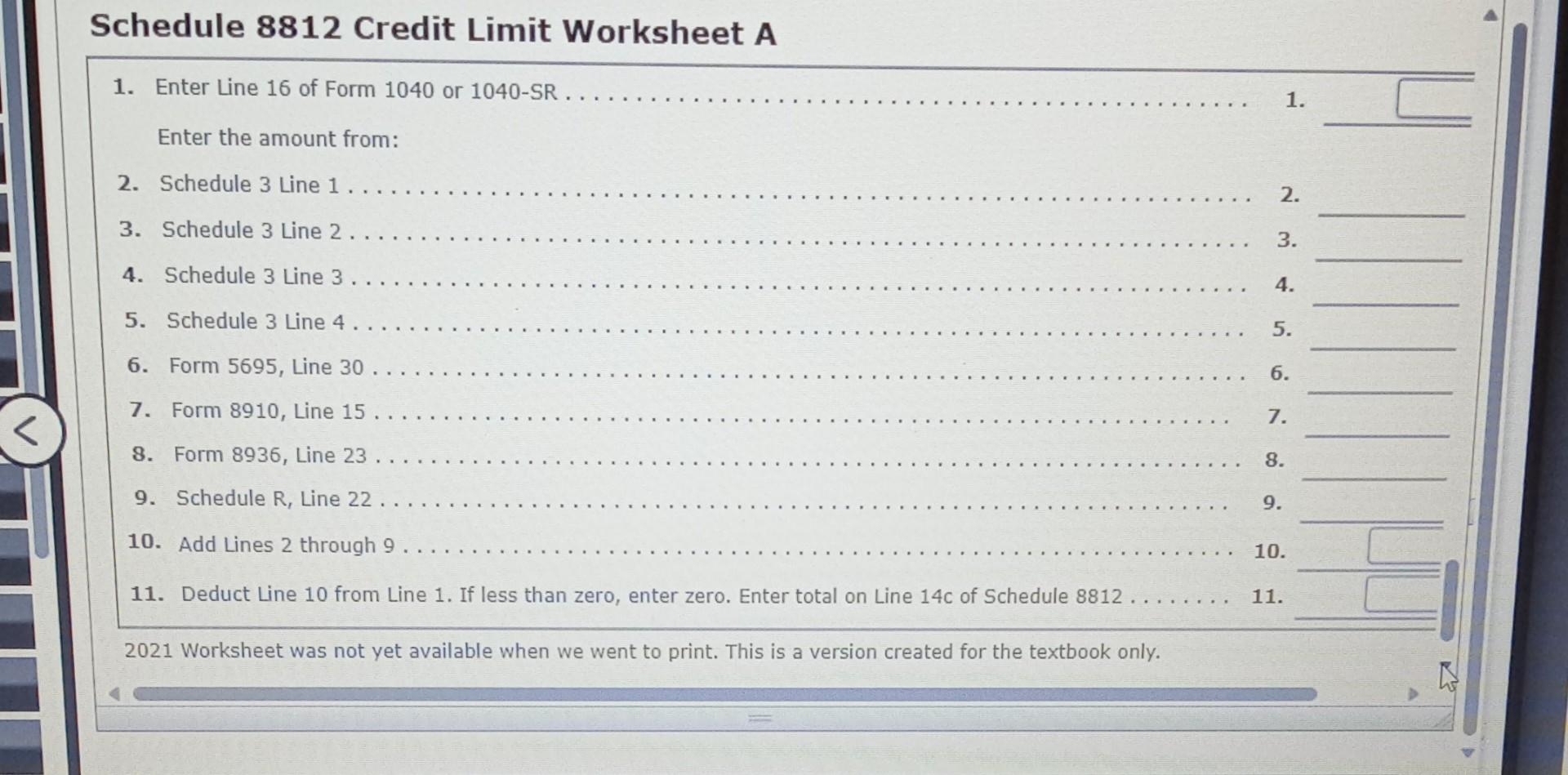

Managing credit limits is an essential part of financial planning for individuals and businesses. Credit Limit Worksheet A is a tool that helps calculate the maximum amount of credit that can be extended to a borrower. This worksheet takes into account various factors such as income, expenses, and existing debts to determine a safe and manageable credit limit.

By using Credit Limit Worksheet A, lenders can assess the financial health of a borrower and make informed decisions about extending credit. This tool helps prevent borrowers from taking on more debt than they can handle, reducing the risk of default and financial instability.

Instructions Schedule 8812 Herb And Carols Child Chegg (worksheets.clipart-library.com)

Instructions Schedule 8812 Herb And Carols Child Chegg (worksheets.clipart-library.com)

When using Credit Limit Worksheet A, it is important to accurately input all relevant financial information to ensure an accurate calculation. This includes details such as monthly income, expenses, outstanding debts, and any other financial commitments. By providing accurate data, borrowers can receive a credit limit that is tailored to their financial situation.

One of the key benefits of Credit Limit Worksheet A is that it promotes responsible borrowing and helps individuals and businesses avoid overextending themselves financially. By setting a realistic credit limit based on their financial circumstances, borrowers can avoid falling into a cycle of debt and financial hardship.

In conclusion, Credit Limit Worksheet A is a valuable tool for both lenders and borrowers in managing credit limits effectively. By using this worksheet, borrowers can receive a credit limit that is tailored to their financial situation, reducing the risk of default and financial instability. By promoting responsible borrowing, Credit Limit Worksheet A helps individuals and businesses make informed financial decisions and maintain financial stability.