Managing debt can be overwhelming, especially when you have multiple accounts with varying balances and interest rates. One effective strategy for paying off debt is the debt snowball method, popularized by financial expert Dave Ramsey. This method involves paying off your debts from smallest to largest, gaining momentum as you eliminate each one.

One helpful tool to use in conjunction with the debt snowball method is a debt snowball worksheet. This worksheet allows you to track your debts, create a plan for repayment, and visualize your progress as you work towards becoming debt-free.

A Printable Debt Snowball Worksheet Is Shown In This Image It Shows The (www.pinterest.com.au)

A Printable Debt Snowball Worksheet Is Shown In This Image It Shows The (www.pinterest.com.au)

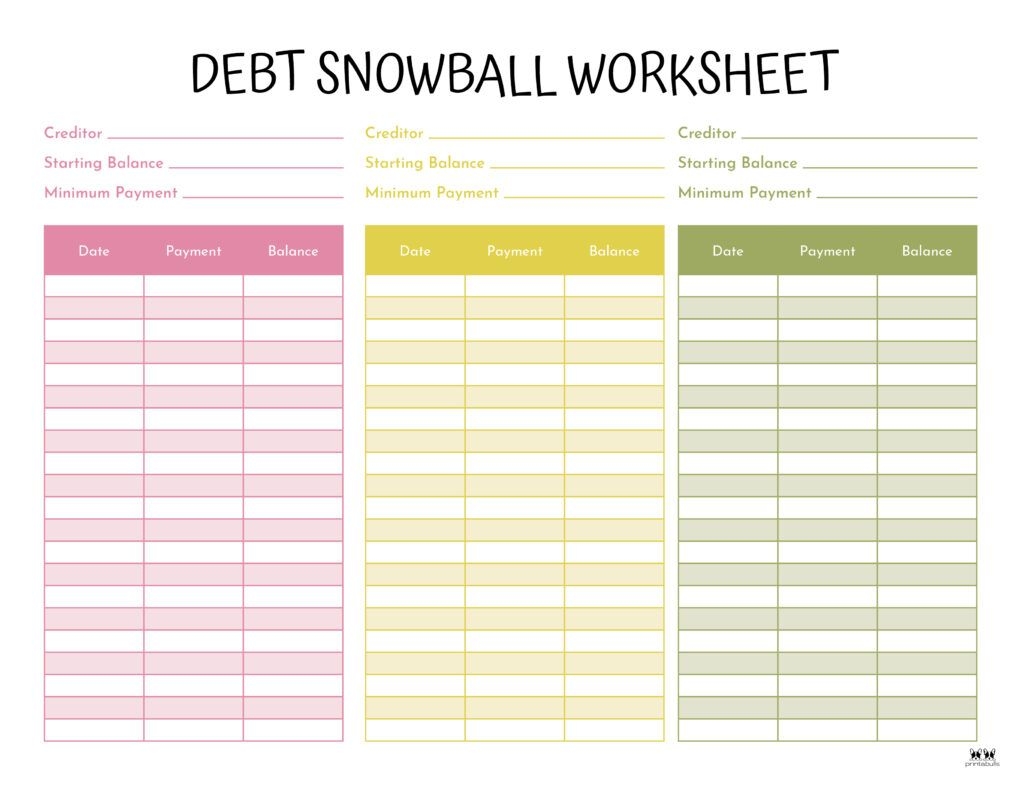

Debt Snowball Worksheet

A debt snowball worksheet typically includes columns for listing each of your debts, including the balance, interest rate, minimum payment, and current status. You can then prioritize your debts based on their balances, starting with the smallest one first. By focusing on paying off one debt at a time while making minimum payments on the others, you can build momentum and stay motivated throughout the process.

As you pay off each debt, you can then roll the amount you were paying towards that debt into the next one on your list. This snowball effect allows you to accelerate your debt repayment and see tangible results as you make progress towards your financial goals.

Using a debt snowball worksheet can also help you stay organized and on track with your payments. By having a clear plan in place, you can avoid missing payments or falling behind on your debts. Additionally, seeing your progress on paper can provide motivation and encouragement to continue working towards financial freedom.

Overall, a debt snowball worksheet is a valuable tool for anyone looking to pay off debt efficiently and effectively. By following the debt snowball method and utilizing a worksheet to track your progress, you can take control of your finances and work towards a debt-free future.

Start using a debt snowball worksheet today and take the first step towards achieving financial freedom.