Managing finances is a crucial aspect of running a successful business. One of the most commonly used tools for tracking financial performance is an Excel sheet. By creating a Profit Loss Excel Sheet, businesses can easily monitor their revenue and expenses, analyze trends, and make informed decisions to improve profitability.

With a Profit Loss Excel Sheet, businesses can organize their financial data in a structured manner, making it easier to identify areas of strength and weakness. This enables business owners to understand their financial position and take necessary actions to increase revenue and decrease expenses.

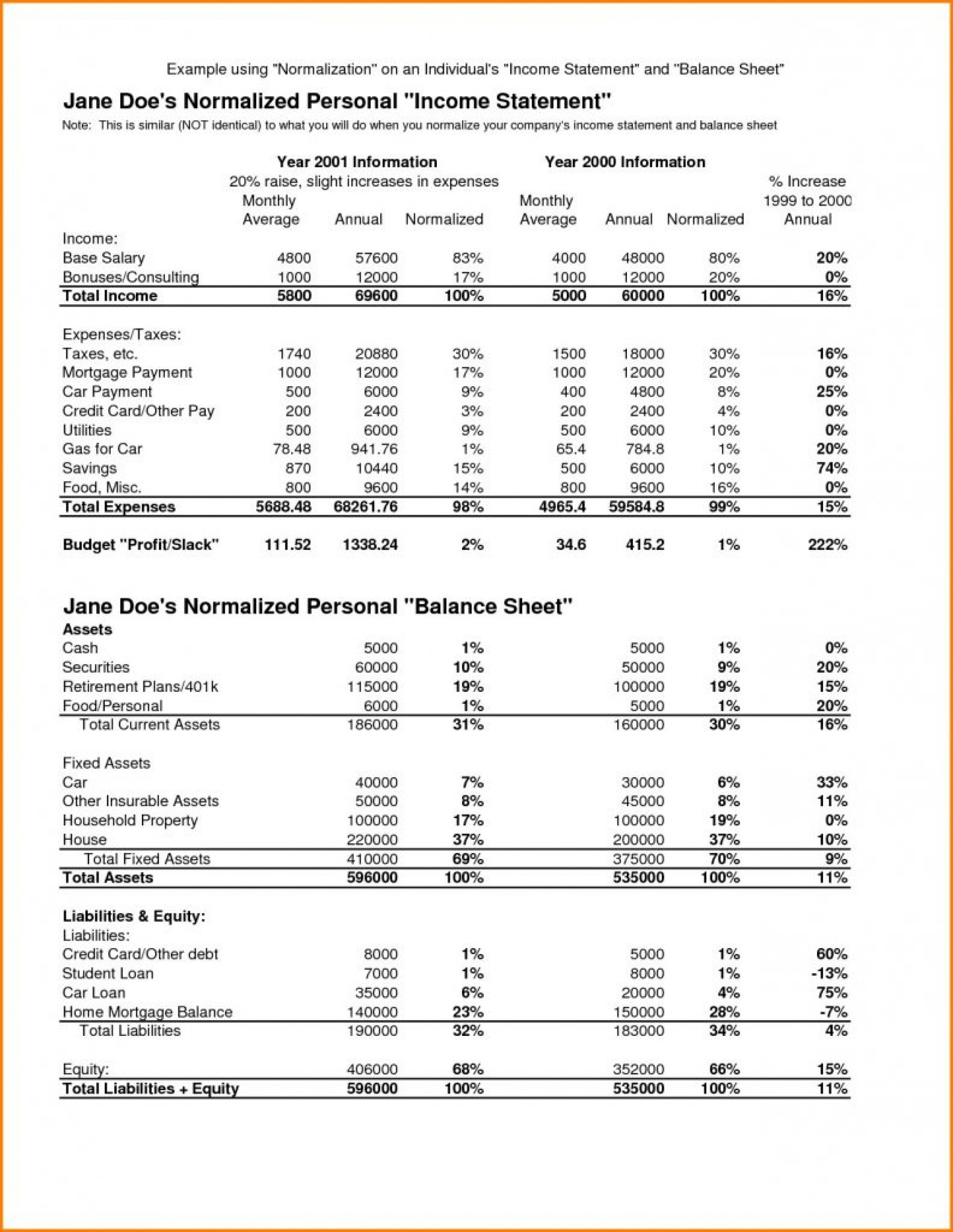

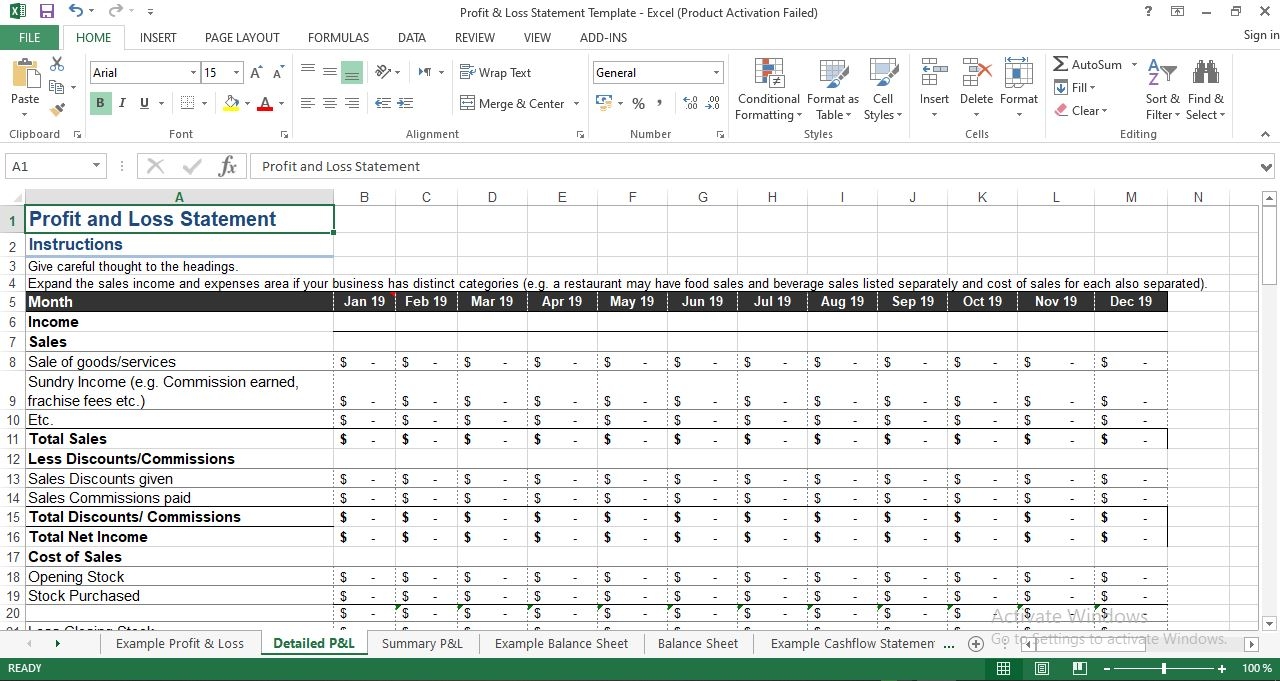

Profit And Loss Statement Excel Balance Sheet Old Format Financial (alayneabrahams.com)

Profit And Loss Statement Excel Balance Sheet Old Format Financial (alayneabrahams.com)

One of the key benefits of using an Excel sheet for tracking profit and loss is the ability to create customizable reports and charts. By inputting data into the sheet, businesses can generate visual representations of their financial performance, such as income statements and balance sheets, which can help identify patterns and trends over time.

Additionally, Excel sheets offer the flexibility to make adjustments and updates to financial data in real-time. This means that businesses can quickly adapt to changes in the market and make strategic decisions to improve their bottom line. By regularly updating the Profit Loss Excel Sheet, businesses can stay on top of their financial performance and make informed decisions for the future.

In conclusion, a Profit Loss Excel Sheet is a valuable tool for businesses to track their financial performance, analyze trends, and make informed decisions to improve profitability. By using Excel, businesses can create customizable reports, charts, and graphs to visualize their financial data and make strategic decisions. With the flexibility to make real-time updates, businesses can stay ahead of the curve and drive their success in the competitive business landscape.