When it comes to filing your taxes, it’s essential to understand the different types of income and how they are taxed. One important aspect to consider is qualified dividends and capital gains. These types of income are taxed at a lower rate compared to ordinary income, making them a popular choice for investors. To calculate the tax on these types of income, you may need to fill out a Qualified Dividends And Capital Gains Worksheet.

Qualified dividends are dividends paid by a U.S. corporation or a qualified foreign corporation. These dividends are taxed at the capital gains tax rates, which are typically lower than ordinary income tax rates. Capital gains, on the other hand, are profits from the sale of investments such as stocks, bonds, or real estate. Like qualified dividends, capital gains are also taxed at lower rates.

Qualified Dividends And Capital Gain Tax Worksheet 2017 Worksheet (www.thesecularparent.com)

Qualified Dividends And Capital Gain Tax Worksheet 2017 Worksheet (www.thesecularparent.com)

Qualified Dividends And Capital Gains Worksheet

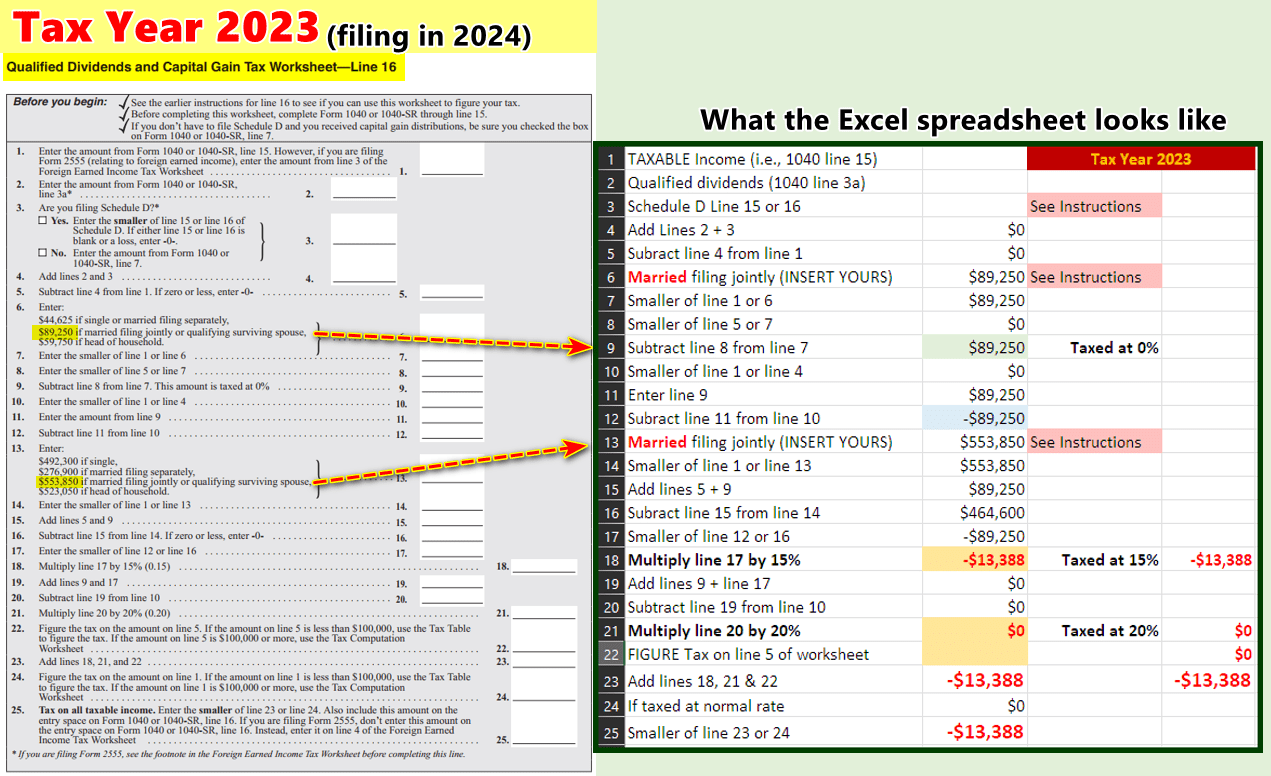

The Qualified Dividends And Capital Gains Worksheet is used to calculate the tax on your qualified dividends and capital gains. This worksheet takes into account various factors such as your filing status, total income, and the amount of qualified dividends and capital gains you received during the tax year. By filling out this worksheet, you can determine the tax rate that applies to your qualified dividends and capital gains.

To fill out the worksheet, you will need to gather information such as the total amount of qualified dividends and capital gains, as well as any adjustments or deductions that may apply. The worksheet will guide you through the calculations to determine the taxable amount of your qualified dividends and capital gains, and ultimately, the tax you owe on this income.

It’s important to note that not all dividends and capital gains are considered qualified. Some dividends, such as those from money market accounts or certain foreign corporations, may not qualify for the lower tax rates. Additionally, capital gains from the sale of certain assets may be subject to different tax treatment. Consulting with a tax professional can help ensure that you accurately calculate the tax on your qualified dividends and capital gains.

In conclusion, understanding how qualified dividends and capital gains are taxed can help you make informed decisions about your investments and tax planning. By using the Qualified Dividends And Capital Gains Worksheet, you can accurately calculate the tax on this type of income and ensure compliance with tax laws. Taking the time to fill out this worksheet can ultimately save you money and simplify the tax filing process.