As we approach the tax season in 2024, it’s important to understand the Taxable Social Security Worksheet and how it may impact your tax liability. Social Security benefits can be taxable depending on your total income, and this worksheet helps determine the taxable portion of your benefits.

Many retirees rely on Social Security as a significant source of income during their golden years. However, it’s crucial to be aware of the tax implications of these benefits to avoid any surprises come tax season.

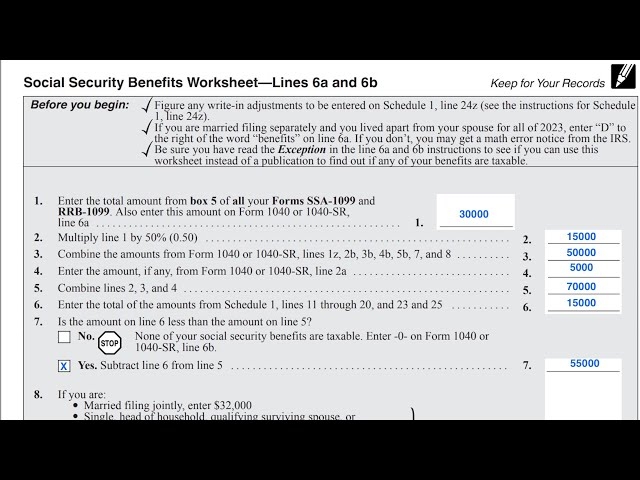

Social Security Benefits Worksheet Walkthrough IRS Form 1040 (worksheets.clipart-library.com)

Social Security Benefits Worksheet Walkthrough IRS Form 1040 (worksheets.clipart-library.com)

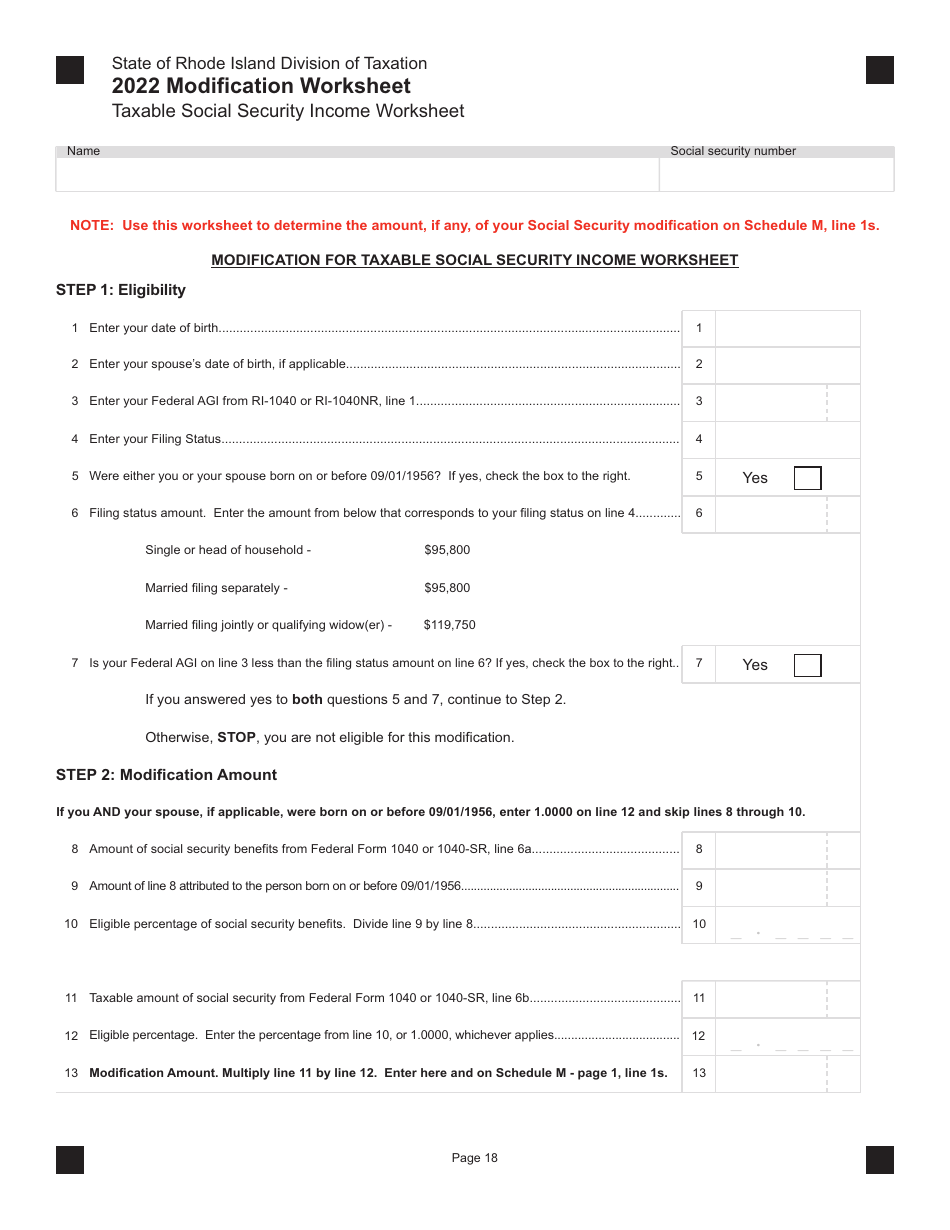

Taxable Social Security Worksheet 2024

The Taxable Social Security Worksheet for 2024 follows a specific formula to calculate the taxable portion of your benefits. It takes into account your adjusted gross income, nontaxable interest, and half of your Social Security benefits to determine the final amount that is subject to taxation.

First, you will need to calculate your combined income, which includes your adjusted gross income, nontaxable interest, and half of your Social Security benefits. The worksheet then provides a formula to determine the taxable portion of your Social Security benefits based on your filing status and income level.

It’s important to note that not all Social Security benefits are taxable. If your income is below a certain threshold, you may not owe any taxes on your benefits. However, if your income exceeds the threshold, a portion of your benefits may be subject to taxation.

By understanding the Taxable Social Security Worksheet for 2024 and how it applies to your individual situation, you can better plan for any potential tax liabilities and ensure that you are not caught off guard come tax season. Consulting with a tax professional can also help you navigate the complexities of the tax code and maximize your tax savings.

As you prepare for the upcoming tax season, be sure to familiarize yourself with the Taxable Social Security Worksheet for 2024 and how it may impact your tax return. By staying informed and proactive, you can effectively manage your tax obligations and make the most of your retirement benefits.