Capital loss carryover is a tax provision that allows individuals to carry over a capital loss from one year to offset capital gains in future years. This can help taxpayers reduce their overall tax liability and potentially save money on taxes. The Capital Loss Carryover Worksheet is a tool provided by the Internal Revenue Service (IRS) to help taxpayers calculate and keep track of their capital losses and carryovers.

The Capital Loss Carryover Worksheet is used to determine the amount of capital loss that can be carried over to future years. It helps taxpayers keep track of their capital gains and losses, and calculate the net capital loss for each year. The worksheet takes into account factors such as the type of asset sold, the purchase price, the selling price, and any adjustments or deductions that may apply.

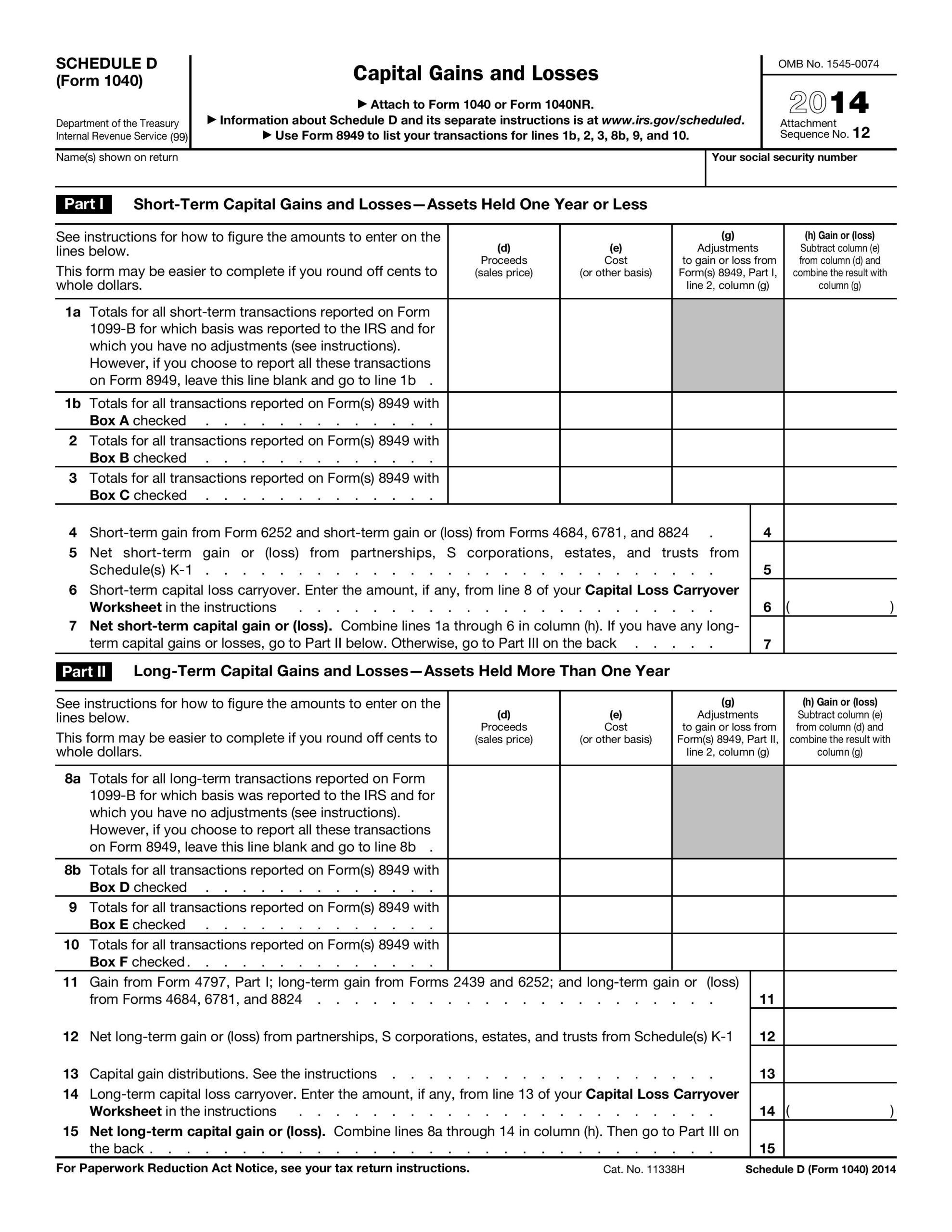

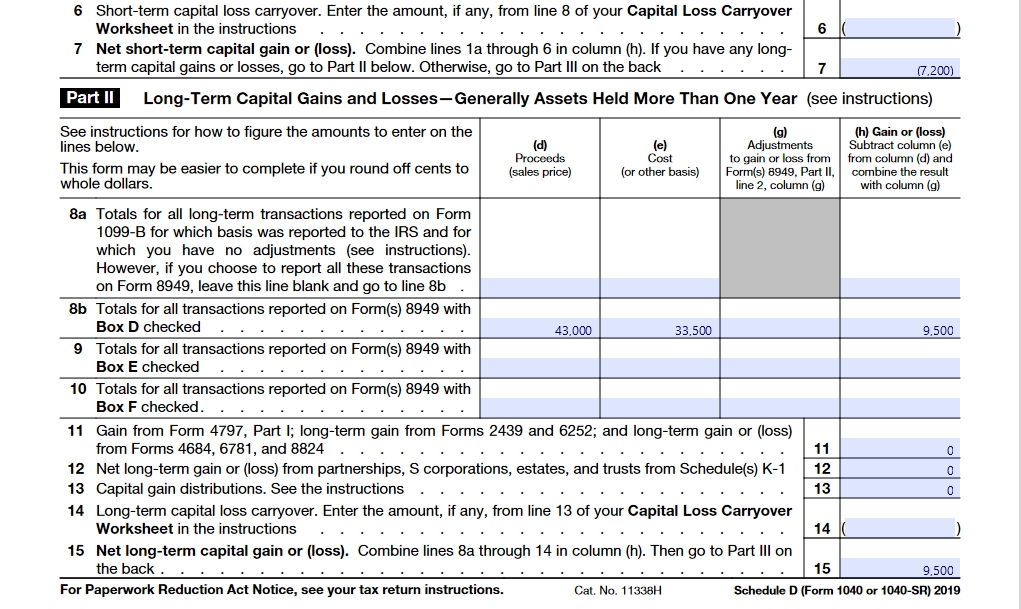

6 6 Short Term Capital Loss Carryover Enter The Chegg (worksheets.clipart-library.com)

6 6 Short Term Capital Loss Carryover Enter The Chegg (worksheets.clipart-library.com)

When a taxpayer has a capital loss in a given year that exceeds their capital gains, the excess loss can be carried over to future years to offset capital gains and reduce taxes owed. The Capital Loss Carryover Worksheet helps taxpayers keep track of these losses and ensures they are applied correctly in future tax years.

It is important for taxpayers to accurately complete the Capital Loss Carryover Worksheet and keep detailed records of their capital gains and losses. Failing to properly document and track capital losses could result in errors on tax returns and potential penalties from the IRS. By using the worksheet and staying organized, taxpayers can take full advantage of the capital loss carryover provision and minimize their tax liability.

In conclusion, the Capital Loss Carryover Worksheet is a valuable tool for taxpayers looking to offset capital gains and reduce their tax burden. By carefully completing the worksheet and keeping detailed records of their capital gains and losses, individuals can take advantage of this tax provision and potentially save money on taxes in the long run.