Constructed Travel Worksheet is a vital tool used by employees who are required to travel for work purposes. It helps them to accurately report their travel expenses and ensure compliance with company policies and regulations. By using this worksheet, employees can track their travel expenses, such as transportation, lodging, meals, and other incidental expenses, in an organized manner.

Having a well-documented travel worksheet is essential for both the employee and the employer. It provides a clear record of all expenses incurred during the trip, which can be used for reimbursement purposes. Additionally, it helps the employer to monitor and control travel costs, ensuring that the company’s budget is being utilized efficiently.

PPT T 200 CONSTRUCTED TRAVEL IN DTS PowerPoint Presentation (worksheets.clipart-library.com)

PPT T 200 CONSTRUCTED TRAVEL IN DTS PowerPoint Presentation (worksheets.clipart-library.com)

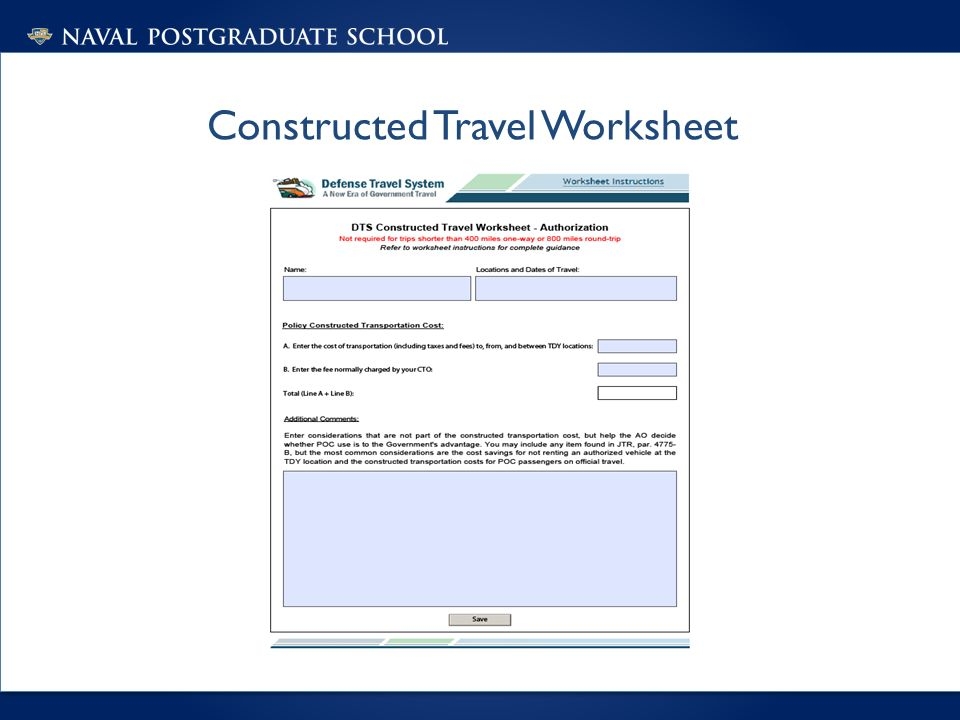

Constructed Travel Worksheet

The Constructed Travel Worksheet typically includes sections for the employee to input details such as the purpose of the trip, dates of travel, mode of transportation, accommodation details, meal expenses, and any other relevant expenses. It also allows the employee to attach receipts and other supporting documents for verification purposes.

By accurately documenting all travel expenses on the worksheet, employees can avoid any discrepancies or misunderstandings when it comes to reimbursement. It also helps in identifying any areas where costs can be reduced or optimized for future trips.

Furthermore, the Constructed Travel Worksheet serves as a valuable tool for auditing purposes. In case of any discrepancies or questions regarding the travel expenses, having a well-maintained worksheet can provide a clear trail of all expenses and help in resolving any issues efficiently.

In conclusion, a Constructed Travel Worksheet is an essential tool for employees who frequently travel for work. It helps in maintaining accurate records of travel expenses, ensuring compliance with company policies, and facilitating smooth reimbursement processes. By utilizing this worksheet effectively, employees and employers can streamline the travel expense reporting process and optimize travel costs.